Fueling Financial Growth: Zions Bancorporation’s loan solutions have positioned the company at the forefront of financial growth, and in this section of the article, we’ll take a closer look at their impact. We’ll analyze their loan strategies, evaluate their business strategies, and conduct a financial analysis to gain greater insight into their performance.

Zions Bancorporation has employed innovative strategies to stay ahead in the banking industry, and we’ll explore how their loan solutions have contributed towards their financial success. We’ll also examine their overall financial performance and identify key metrics that highlight the effectiveness of their business strategies.

Understanding Zions Bancorporation and the Banking Industry

As a renowned financial institution, Zions Bancorporation has established a firm foothold in the banking industry. To better appreciate the significance of their loan solutions, it’s important to understand their position in the market.

Recent financial news related to Zions Bancorporation suggests a positive outlook for the company’s growth and performance.

The banking industry is a complex and dynamic field that experiences constant changes in market trends. By staying informed about these trends, Zions Bancorporation has been able to innovate and stay competitive in the industry. These market trends have influenced the company’s operations.

Market Trends Impacting Zions Bancorporation

| Market Trends | Impact on Zions Bancorporation |

|---|---|

| Rise of Digital Banking | Investment in innovative digital strategies to stay competitive |

| Changes in Regulatory Environment | Adaptation of compliance procedures to comply with new regulations |

| Increasing Focus on ESG | Implementation of sustainable business practices to meet growing demand from consumers and investors |

By understanding Zions Bancorporation’s position in the banking industry and the latest market trends, we can better appreciate the company’s loan solutions and strategies. In the next section, we will explore these strategies in more detail.

Examining Zions Bancorporation’s Loan Strategies

At the core of Zions Bancorporation’s success are their innovative loan strategies. Through their various business strategies, the company has been able to offer loan solutions that not only drive their financial growth.

One of Zions Bancorporation’s main loan strategies is their focus on small businesses. By offering loans to small businesses, Zions Bancorporation is able to support entrepreneurs.

In addition, Zions Bancorporation has also implemented technology-based solutions that streamline the loan application and approval process.

Recent updates within the company include their acquisition of Moniker Partners, a merger that will strengthen Zions Bancorporation’s position in the investment banking industry.

Zions Bancorporation’s Investment Opportunities

With their diverse loan options and commitment to supporting small businesses, Zions Bancorporation offers attractive investment opportunities for individuals looking to invest in a financially stable and socially responsible company. Additionally, their recent acquisition of Moniker Partners presents new investment opportunities for those interested in investment banking.

Analyzing Zions Bancorporation’s Financial Performance

In recent years, Zions Bancorporation has experienced significant growth in their financial performance. A comprehensive financial analysis shows that the company has achieved a steady increase in revenue and profitability.

The company’s total revenue for the last fiscal year stood at $2.9 billion, which represents a growth of 7.5% compared to the previous year. Moreover, Zions Bancorporation’s net income has also increased by 16% over the same period, from $669 million to $776 million.

Furthermore, their investment in technology has resulted in a more streamlined and efficient process for loan origination and management, which has translated to increased revenue and reduced costs.

Overall, the financial analysis demonstrates that Zions Bancorporation’s loan solutions have been a significant factor in the company’s success. With a commitment to delivering innovative solutions.

Frequently Asked Questions

Fueling Financial Growth: What loan solutions does Zions Bancorporation offer?

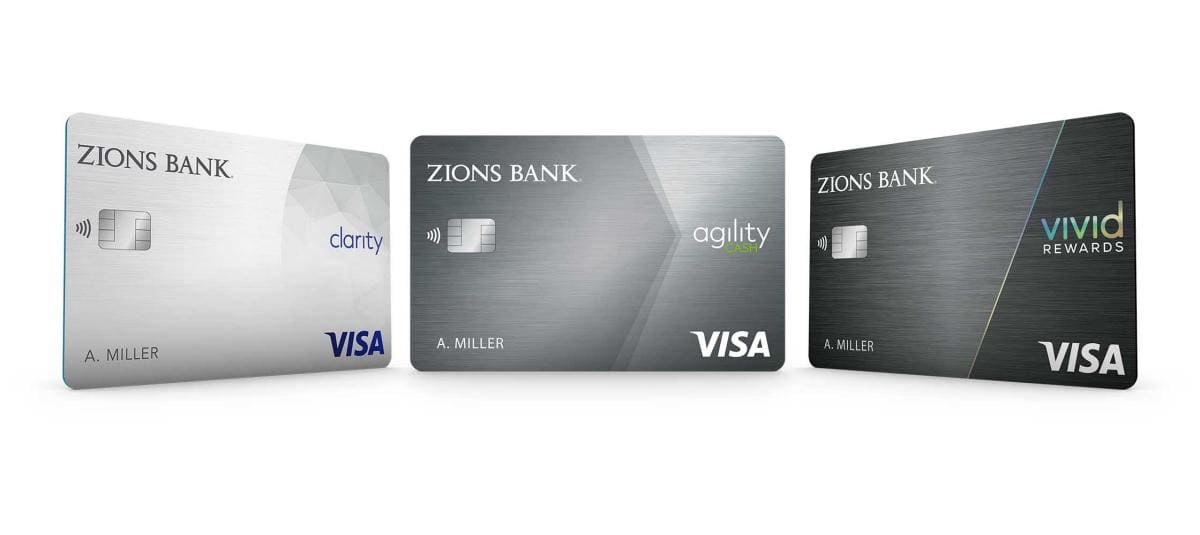

Zions Bancorporation offers a wide range of loan solutions, including personal loans, business loans and more. Their loan offerings cater to the diverse needs of individuals, small businesses, and corporations.

Fueling Financial Growth: How have Zions Bancorporation’s loan solutions contributed to their financial growth?

Zions Bancorporation’s loan solutions have played a pivotal role in driving their financial growth. By offering competitive interest rates, flexible terms.

Fueling Financial Growth: What innovative strategies does Zions Bancorporation use in the banking industry?

Zions Bancorporation employs various innovative strategies in the banking industry, such as leveraging advanced technology to streamline loan processing, implementing data-driven decision-making processes, and focusing on customer-centric services. These strategies help them stay ahead in a rapidly evolving market.

What are some investment opportunities arising from Zions Bancorporation’s loan solutions?

Zions Bancorporation’s loan solutions offer potential investment opportunities for individuals and institutions interested in the banking sector. Investors can consider investing in Zions Bancorporation stocks or bonds, which may benefit from the company’s financial growth and the demand for their loan products.

Fueling Financial Growth: Can you provide some recent updates on Zions Bancorporation’s loan strategies?

Zions Bancorporation regularly updates its loan strategies to adapt to market trends and customer needs. Some recent updates include expanding their small business lending division, introducing new loan products for specific industries, and enhancing digital banking capabilities to provide a seamless borrowing experience.

Fueling Financial Growth: How does Zions Bancorporation’s financial performance reflect the success of their loan solutions?

Zions Bancorporation’s financial performance showcases the success of their loan solutions. Their loan portfolio growth, increased profitability.

Find out more at: https://zionsbancorporation.com/overview/corporate-profile/default.aspx